Understanding the impact of interest rates is crucial in managing personal finances. Whether it’s loans, credit cards, or savings accounts, the fluctuation of interest rates can significantly affect our financial decisions and overall financial well-being. In this article, we will delve into the various ways that interest rates can influence our personal finances and how we can navigate through these changes effectively.

Understanding the Relationship Between Interest Rates and Personal Finance

Interest rates play a significant role in personal finance, influencing various aspects of our financial lives. Whether it’s borrowing money, saving, or investing, understanding the relationship between interest rates and personal finance is essential.

Firstly, interest rates impact the cost of borrowing money. When interest rates are low, it becomes cheaper to borrow, making it an opportune time to take out loans for various purposes, such as buying a house or starting a business. Conversely, high interest rates can make borrowing more expensive, potentially limiting our ability to make significant purchases.

Secondly, interest rates affect our savings. When interest rates are high, savings accounts and other conservative investment options tend to provide better returns. On the other hand, low-interest rates may not offer substantial growth for our savings, leading to potential inflation risks over time.

Moreover, interest rates can influence consumer spending. Lower interest rates can incentivize consumers to spend more, as the cost of borrowing is reduced, allowing for more significant purchases and increased economic activity. Conversely, higher interest rates may encourage individuals to save more and spend less, potentially slowing down economic growth.

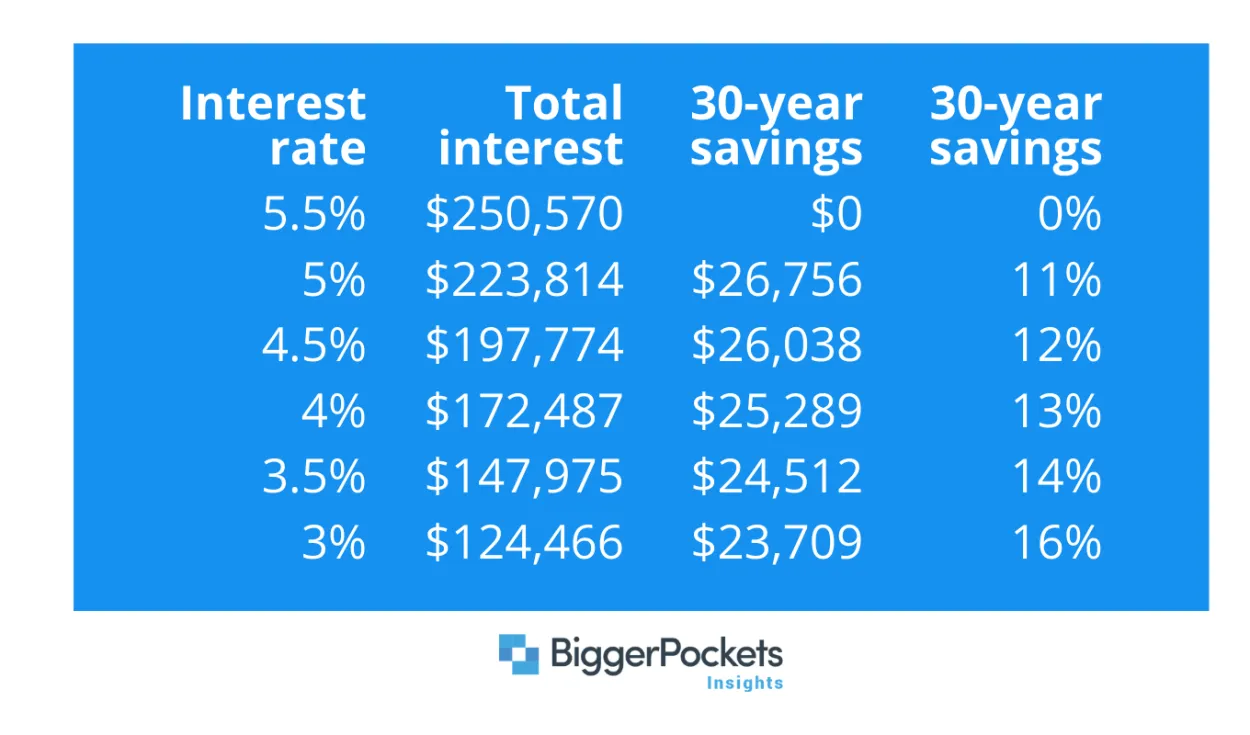

Furthermore, interest rates have an impact on the housing market. When interest rates are low, mortgages become more affordable, increasing the demand for homeownership. Conversely, higher interest rates can dampen the housing market, making it less accessible for potential buyers.

Lastly, interest rates affect investment decisions. Lower interest rates can make riskier assets, such as stocks, more attractive because the returns from safer investments may be lower. Conversely, higher interest rates can make safer investments, such as bonds, more appealing due to the potential for higher returns.

In conclusion, the relationship between interest rates and personal finance is crucial. By understanding how interest rates affect borrowing costs, savings, consumer spending, the housing market, and investment decisions, individuals can make informed financial choices that align with their goals and financial well-being.

Effects of Low and High Interest Rates on Borrowing and Saving

Interest rates play a significant role in shaping personal finances. Whether they are low or high, interest rates have various effects on borrowing and saving. Understanding these effects is crucial for individuals seeking to make informed financial decisions.

Effects of Low Interest Rates

1. Increased borrowing: Low interest rates make borrowing more affordable because the cost of borrowing decreases. This encourages individuals to take on loans for various purposes such as mortgages, car purchases, or starting a business.

2. Stimulated economic growth: Low interest rates incentivize spending and investment, which spur economic growth. With lower borrowing costs, businesses can invest in expansion, leading to job creation and increased consumer spending.

3. Reduced savings returns: While borrowing becomes cheaper, saving becomes less rewarding. Low interest rates result in lower returns on savings accounts and other low-risk investments, pushing individuals towards riskier investment options to seek higher returns.

Effects of High Interest Rates

1. Decreased borrowing: High interest rates make borrowing more expensive, causing individuals and businesses to reduce their borrowing activities. This can dampen economic growth as less money is being injected into the economy through loans.

2. Increased saving: High interest rates offer better returns on savings, making saving more attractive. Individuals may opt to save more in bank accounts, fixed deposits, or other low-risk investments to take advantage of the higher interest rates.

3. Inflation control: Higher interest rates can be used by central banks to control inflation. By making borrowing more expensive, individuals and businesses are encouraged to reduce their spending, reducing the demand for goods and services and ultimately curbing inflationary pressures.

Conclusion

Interest rates have a profound impact on borrowing and saving. Whether they are low or high, interest rates influence consumer behavior, economic activity, and investment decisions. It is crucial for individuals to monitor interest rate changes and consider their effects when managing personal finances.

How Interest Rates Affect Mortgage and Credit Card Payments

When it comes to managing personal finance, understanding the impact of interest rates is crucial. Interest rates can significantly affect mortgage and credit card payments, making it important for individuals to stay informed about these fluctuations.

Firstly, let’s explore how interest rates impact mortgage payments. The interest rate on a mortgage loan determines the amount of money borrowed from the lender that needs to be paid back over time. When interest rates are low, individuals can enjoy lower monthly mortgage payments. Conversely, when interest rates rise, monthly mortgage payments increase, which can burden homeowners financially.

Additionally, interest rates also play a role in credit card payments. Credit card interest rates are typically higher compared to mortgage rates. When interest rates rise, credit cardholders may experience higher interest charges on their outstanding balances. This means that a larger portion of their monthly payments goes towards interest rather than paying off the principal debt. It is essential for credit cardholders to carefully manage their balances and make timely payments in order to avoid accumulating excessive interest charges.

Furthermore, interest rates can impact individuals’ borrowing capabilities. Higher interest rates make it more expensive to borrow money, as the cost of borrowing increases. This can make it difficult for individuals to qualify for loans or afford higher credit limits on their credit cards. On the other hand, lower interest rates make borrowing more affordable, potentially opening up opportunities for individuals to invest or make large purchases.

In conclusion, interest rates play a vital role in personal finance, especially when it comes to mortgage and credit card payments. The fluctuations in interest rates can significantly impact monthly payments, the time it takes to pay off debts, and overall financial stability. It is important for individuals to monitor interest rate trends and make informed decisions regarding their borrowing and repayment strategies.

Strategies to Manage Personal Finances in a Changing Interest Rate Environment

In today’s fast-paced and dynamic economic landscape, interest rates play a crucial role in personal finance. As interest rates fluctuate, it becomes essential for individuals to adopt effective strategies to manage their finances effectively. Here are some strategies to navigate the changing interest rate environment:

1. Monitor and Understand Interest Rate Trends

Stay updated on the latest trends in interest rates by following financial news and consulting experts. Understand how different interest rates, such as mortgage rates or credit card rates, are affected by changes in the economy. This knowledge will help you make informed decisions regarding your financial planning.

2. Review and Adjust Your Budget

As interest rates change, it is crucial to review your budget regularly. Analyze your income, expenses, and debts, and identify areas where adjustments can be made to accommodate potential changes in interest rates. Ensure that your budget allows for flexibility and includes savings.

3. Evaluate Debt Management Strategies

Interest rates have a significant impact on various debts, such as loans and credit cards. Consider refinancing existing loans to secure more favorable interest rates or consolidating debts to simplify payments. Evaluate the pros and cons of each option and choose the one that best suits your financial situation.

4. Diversify Your Investments

A changing interest rate environment can lead to fluctuations in investment returns. Diversify your investment portfolio to reduce the risk associated with interest rate changes. Consider investing in various asset classes like stocks, bonds, real estate, or mutual funds to spread the risk and maximize potential gains.

5. Build an Emergency Fund

Having an emergency fund is crucial, especially during times of changing interest rates. As rates rise, unexpected expenses or job loss can become more challenging to handle. Aim to build an emergency fund that covers at least three to six months of living expenses to provide financial security.

6. Seek Professional Advice

If you find it challenging to navigate the changing interest rate environment, consider seeking guidance from a financial advisor. A professional can evaluate your specific circumstances, provide personalized advice, and help you develop a comprehensive financial plan that takes into account interest rate fluctuations.

By adopting these strategies, you can better manage your personal finances in a changing interest rate environment. Remember to stay informed, be proactive, and make adjustments when necessary to ensure your financial well-being.

Conclusion

In conclusion, interest rates play a significant role in personal finance. They affect borrowing costs, savings returns, and mortgage payments. It is crucial for individuals to monitor and manage their finances accordingly, as changes in interest rates can have a substantial impact on their overall financial wellbeing.