Are you a beginner interested in diving into the world of investment banking? Look no further! This article will provide you with a comprehensive introduction to investment banking, covering its role, functions, and key concepts. Whether you’re a novice or have some knowledge, this guide will set you on the right path to understanding the intricacies of investment banking.

What is investment banking?

Investment banking is a specialized field within the financial industry that primarily focuses on assisting companies, governments, and other organizations in raising capital through various means. This can include issuing stocks, bonds, and other securities, as well as providing advice on mergers and acquisitions, restructuring, and other financial transactions.

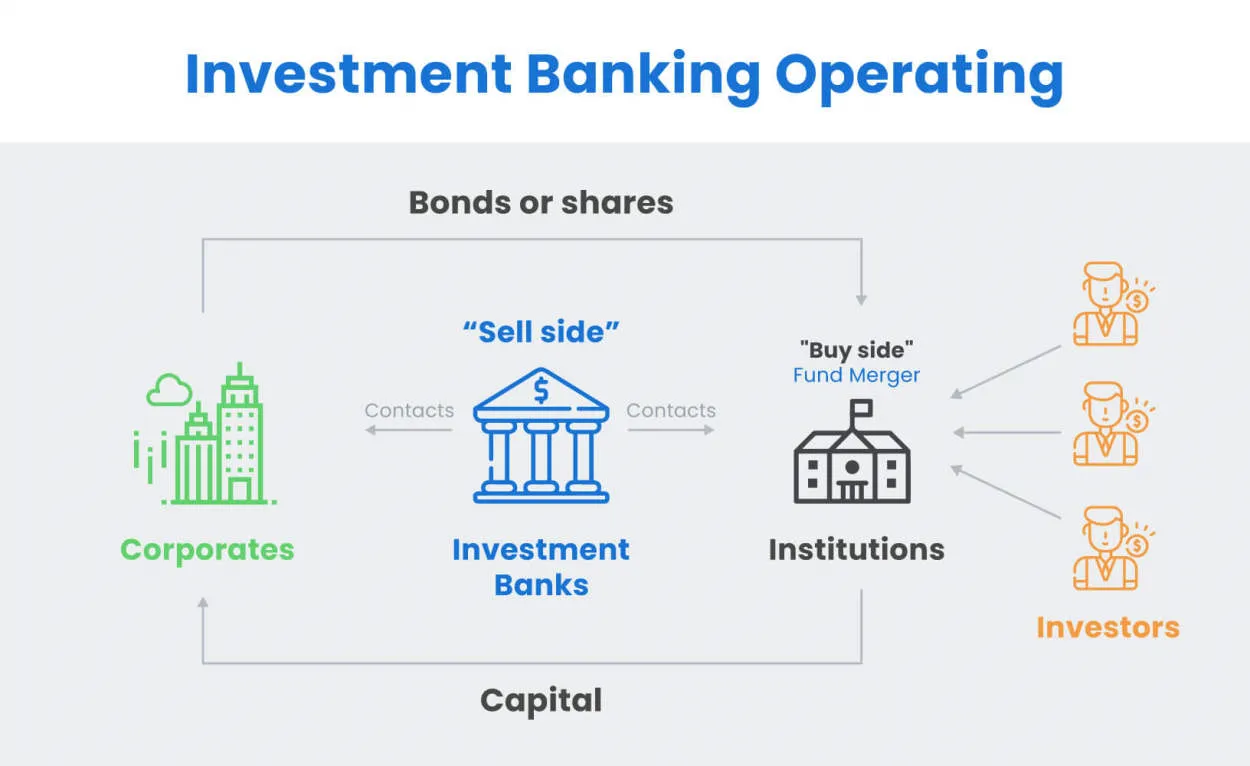

Investment banks act as intermediaries between the companies seeking funding and the investors. They play a crucial role in facilitating the capital-raising process by underwriting offerings, conducting due diligence, and providing research and analysis. Investment banks also offer a range of advisory services to help clients make strategic decisions regarding their finances.

Unlike traditional commercial banks that primarily deal with deposits and loans, investment banks are focused on capital markets activities. They work with both public and private companies, governments, and institutional investors to ensure efficient and effective capital allocation.

Common services provided by investment banks include mergers and acquisitions advice, underwriting securities offerings, sales and trading of securities, asset management, and debt and equity research. The investment banking industry is known for its fast-paced and demanding work environment, where professionals deal with complex financial instruments, high-profile clients, and significant financial transactions.

Roles and Functions of Investment Banks

Investment banks play a vital role in the financial markets and provide a range of services to individuals, businesses, and governments. Here are some of the key roles and functions of investment banks:

1. Capital Raising

One of the primary functions of investment banks is to help companies raise capital. They assist in issuing stocks, bonds, and other securities to investors. This process allows businesses to raise funds for expansion, acquisitions, or to meet other financial needs.

2. Underwriting Securities

Investment banks also act as underwriters for securities offerings. They assume the risk of purchasing and reselling newly issued securities to the public. By assuming this risk, investment banks ensure that the issuing company receives the necessary capital.

3. Mergers and Acquisitions

Investment banks play a crucial role in facilitating mergers and acquisitions. They provide advisory services to companies involved in these transactions, helping them with valuation, negotiation, and deal structuring. Investment banks also assist in finding potential buyers or sellers.

4. Research and Analysis

Investment banks conduct in-depth research and analysis on various companies, industries, and markets. They provide valuable insights through reports and recommendations to assist investors in making informed decisions. This research helps clients identify investment opportunities and manage risks.

5. Trading and Sales

Investment banks have trading and sales desks that facilitate the buying and selling of financial instruments such as stocks, bonds, derivatives, and currencies. They connect buyers and sellers, ensuring liquidity in the markets and providing clients with access to a wide range of investment products.

6. Risk Management

Investment banks help clients manage financial risks by offering risk management products such as derivatives and insurance. They assist in hedging against market volatility, interest rate fluctuations, and currency risks, providing stability and protection to investors.

These are just a few of the key roles and functions of investment banks. Their expertise and services play a vital role in supporting economic growth, facilitating capital flows, and providing the necessary infrastructure for the functioning of financial markets.

Types of Investment Banking Services

Investment banking is a crucial part of the financial industry that provides a range of services to corporations, governments, and individuals. These services are designed to help clients raise capital, facilitate mergers and acquisitions, and provide strategic advice for various financial transactions. Here are some common types of investment banking services:

1. Capital Markets

Investment banks assist clients in raising capital by underwriting securities, such as stocks and bonds, and facilitating their sale in capital markets. This involves determining the appropriate pricing, structuring the offering, and marketing the securities to potential investors.

2. Mergers and Acquisitions (M&A)

Investment banks play a crucial role in mergers, acquisitions, and other corporate transactions. They provide advisory services to clients considering buying or selling businesses, including valuation analysis, negotiating deals, and assisting in the transaction process.

3. Corporate Finance

Investment banks offer various corporate finance services, such as assisting companies in raising debt or equity financing, structuring initial public offerings (IPOs), and providing financial restructuring advice.

4. Asset Management

Some investment banks also have asset management divisions that manage investment portfolios on behalf of institutional and individual clients. These divisions may offer a wide range of investment products, including mutual funds, hedge funds, and private equity funds.

5. Risk Management

Investment banks help clients manage financial risks through derivatives and other risk management strategies. They provide advice and execute trades on various financial products, such as options, futures, and swaps, to mitigate exposure to market volatility.

These are just a few examples of the types of investment banking services available. The industry is dynamic and constantly evolving, adapting to the changing needs of clients and the global financial landscape.

Key skills for a career in investment banking

Working in investment banking requires a specific set of skills and qualities. Here are some key skills that are crucial for a successful career in this field:

- Analytical and critical thinking: Investment bankers need strong analytical skills to assess financial data, identify trends, and make informed decisions. Critical thinking skills are essential for evaluating risks and potential outcomes.

- Financial acumen: A solid understanding of financial principles, including financial markets, economics, and accounting, is essential in investment banking. Proficiency in financial modeling and valuation techniques is also highly valued.

- Attention to detail: In investment banking, precision is paramount. Paying attention to the smallest details in financial statements, contracts, and other documentation is crucial to avoid costly errors.

- Communication skills: Investment bankers need excellent written and verbal communication skills to effectively convey complex financial information to clients and colleagues. Strong presentation skills are also important for pitching ideas and proposals.

- Time management and multitasking: The ability to handle multiple tasks and meet tight deadlines is a must in investment banking. Being organized, prioritizing tasks, and working efficiently under pressure are essential skills.

- Teamwork: Investment bankers often collaborate with colleagues and professionals from various disciplines. Building strong relationships, working well in teams, and being able to delegate effectively are crucial for success.

Developing and honing these skills can greatly increase your chances of a successful career in investment banking. However, keep in mind that industry dynamics and specific job roles may require additional skills and qualifications.

Conclusion

Investment banking provides beginners with a comprehensive understanding of the financial industry and its functions. It serves as a critical intermediary between companies and investors, offering various services such as underwriting, mergers and acquisitions, and financial advisory. Aspiring investors can benefit from learning about investment banking to make informed decisions and navigate the complex world of finance.