Sustainable investing, also known as Socially Responsible Investing (SRI), is a growing trend that allows individuals to support environmental and social goals while maximizing financial returns. By focusing on companies that demonstrate ethical practices and positive contributions to society, investors can align their values with their investment portfolios. This article explores the principles and strategies behind sustainable investing and highlights its potential for a more sustainable future.

What is sustainable investing?

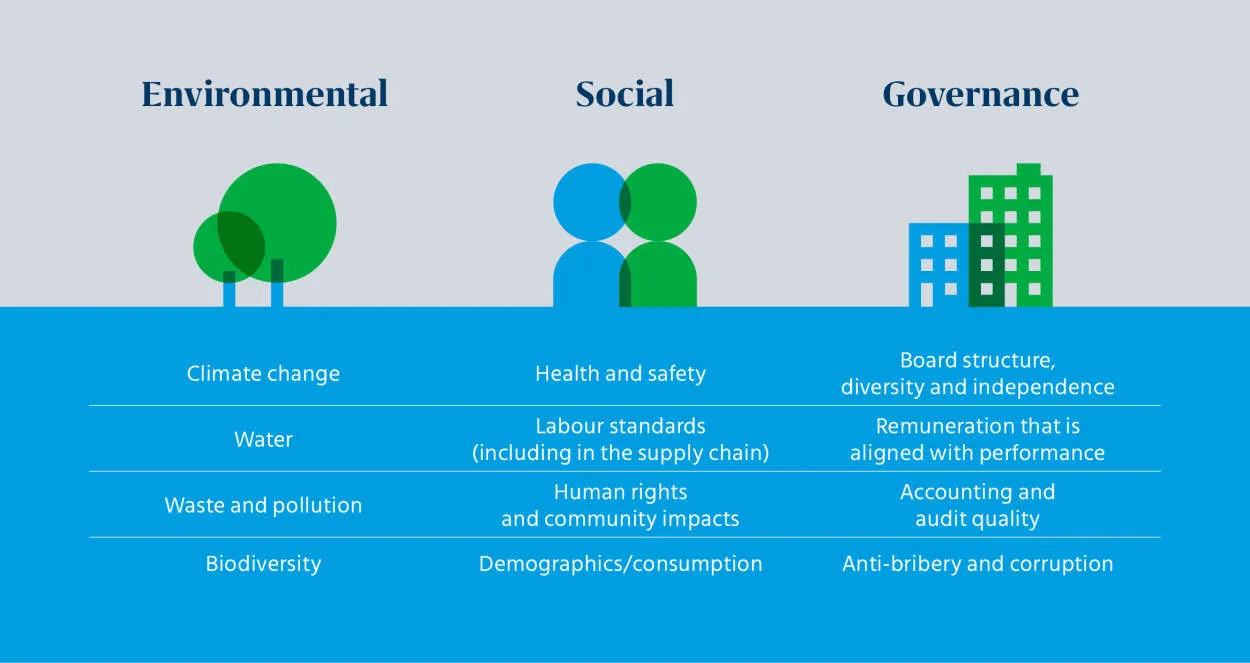

Sustainable investing, also known as socially responsible investing (SRI), is an investment approach that aims to generate long-term financial returns while also considering environmental, social, and governance (ESG) factors. It involves selecting investments in companies or funds that align with certain sustainability criteria or goals.

By incorporating ESG considerations into investment decisions, sustainable investing seeks to support positive environmental and social outcomes. This can include investing in renewable energy, clean technology, climate change adaptation, healthcare, education, and other sectors that contribute to a more sustainable and equitable future.

Investors who engage in sustainable investing take into account factors such as a company’s carbon footprint, labor practices, board diversity, community engagement, and ethical business practices. They aim to support companies that focus on making a positive impact on the world while still achieving financial goals.

Sustainable investing has gained significant traction in recent years as individuals and institutions recognize the importance of addressing environmental and social challenges through their investment choices. It offers an opportunity to align financial goals with personal values, supporting a more sustainable and inclusive world in the process.

Environmental Factors to Consider

In the pursuit of sustainable investing, it is crucial to pay attention to various environmental factors. These factors play a crucial role in understanding the impact of investments on the environment and identifying opportunities to support environmental and social goals.

1. Climate Change

Climate change is one of the most pressing environmental challenges we face today. When making sustainable investment choices, it is important to consider companies that demonstrate a commitment to reducing greenhouse gas emissions, promoting clean energy solutions, and adapting to the changing climate.

2. Natural Resource Management

The responsible management of natural resources is essential for a sustainable future. Investing in companies that prioritize efficient resource utilization, support conservation efforts, and promote sustainable practices can contribute to environmental preservation.

3. Biodiversity Conservation

Protecting biodiversity is crucial for maintaining the health of ecosystems. Sustainable investors can support companies that prioritize biodiversity conservation, avoid harmful practices like deforestation, and promote habitat restoration.

4. Pollution and Waste Management

Addressing pollution and waste is essential for achieving a more sustainable world. Investors can make a positive impact by supporting companies that prioritize pollution prevention, waste reduction, and responsible waste management.

5. Water Stewardship

Ensuring access to clean water and responsible water management are critical for both people and the environment. Sustainable investors can seek out companies that prioritize water conservation, protect water sources, and promote efficient water use.

By considering these environmental factors in our investment decisions, we can contribute to a more sustainable future, support companies that align with our values, and drive positive change for the environment and society as a whole.

Social Factors to Consider

When it comes to sustainable investing, it is essential to consider not just environmental goals, but also the social impact of your investments. Social factors play a crucial role in sustainable investing, as they reflect how companies promote fair and equitable practices, improve working conditions, and contribute positively to society.

Here are some key social factors to consider:

- Employee welfare: Look for companies that prioritize employee well-being, fair wages, and work-life balance. Investing in companies that value their employees can lead to positive societal impacts.

- Diversity and inclusion: Supporting companies with diverse and inclusive workplaces can help promote equal opportunities for all individuals, regardless of their gender, race, or background.

- Community engagement: Consider companies that actively engage with local communities and contribute towards their development. This can include supporting education, healthcare, or environmental initiatives in the areas they operate in.

- Supply chain ethics: Investigate how companies manage their supply chains. Look for ethical practices, including fair trade, responsible sourcing, and efforts to minimize negative social impacts within their supply chains.

- Consumer protection: Choose companies that prioritize consumer safety, transparency, and ethical marketing practices. These companies actively work to protect the rights and well-being of their customers.

By considering these social factors in sustainable investing decisions, you can make a positive impact on society while also supporting your environmental goals.

Investment Strategies for Sustainable Investing

When it comes to sustainable investing, it is crucial to align your investments with environmental and social goals. Here are some effective investment strategies that can help support these objectives:

- Socially Responsible Investing: This approach involves investing in companies that demonstrate a commitment to environmental sustainability, social justice, and corporate governance. By selecting companies that prioritize these values, you can contribute to positive change.

- Impact Investing: Impact investing focuses on investing in companies or projects that have measurable and positive social or environmental impacts. This strategy allows you to leverage your capital to create tangible change in areas like renewable energy, education, healthcare, or affordable housing.

- ESG Integration: Environmental, Social, and Governance (ESG) integration involves considering ESG factors when making investment decisions. By incorporating these criteria into your portfolio analysis, you can potentially identify financially sustainable companies that align with environmental and social goals.

- Divestment: Divesting from companies or industries that have a negative impact on the environment or society is another strategy for sustainable investing. By removing financial support from these entities, you send a powerful message and discourage harmful practices.

It’s important to note that these strategies should be tailored to your own financial goals and risk tolerance. Consulting with a professional financial advisor who specializes in sustainable investing can provide additional guidance and ensure your investments align with your values.

Conclusion

In conclusion, sustainable investing offers individuals and institutions the opportunity to align their financial goals with environmental and social objectives. By investing in companies and organizations that prioritize sustainability, investors can support the transition to a greener and more inclusive economy. Sustainable investing not only generates competitive financial returns but also contributes to a more sustainable future for the planet and society as a whole.