In this article, we will explore the key metrics you need to consider when conducting a financial health checkup. Evaluating these metrics will help you assess the overall health of your finances and make informed decisions for a secure and stable financial future.

Understanding the Importance of Financial Health

Financial health is a crucial aspect of our lives that should be regularly evaluated. Just like our physical health, it is important to monitor and maintain our financial well-being to ensure long-term stability and achieve our goals. By conducting a financial health checkup regularly, we can assess our current financial status and take the necessary steps to improve it.

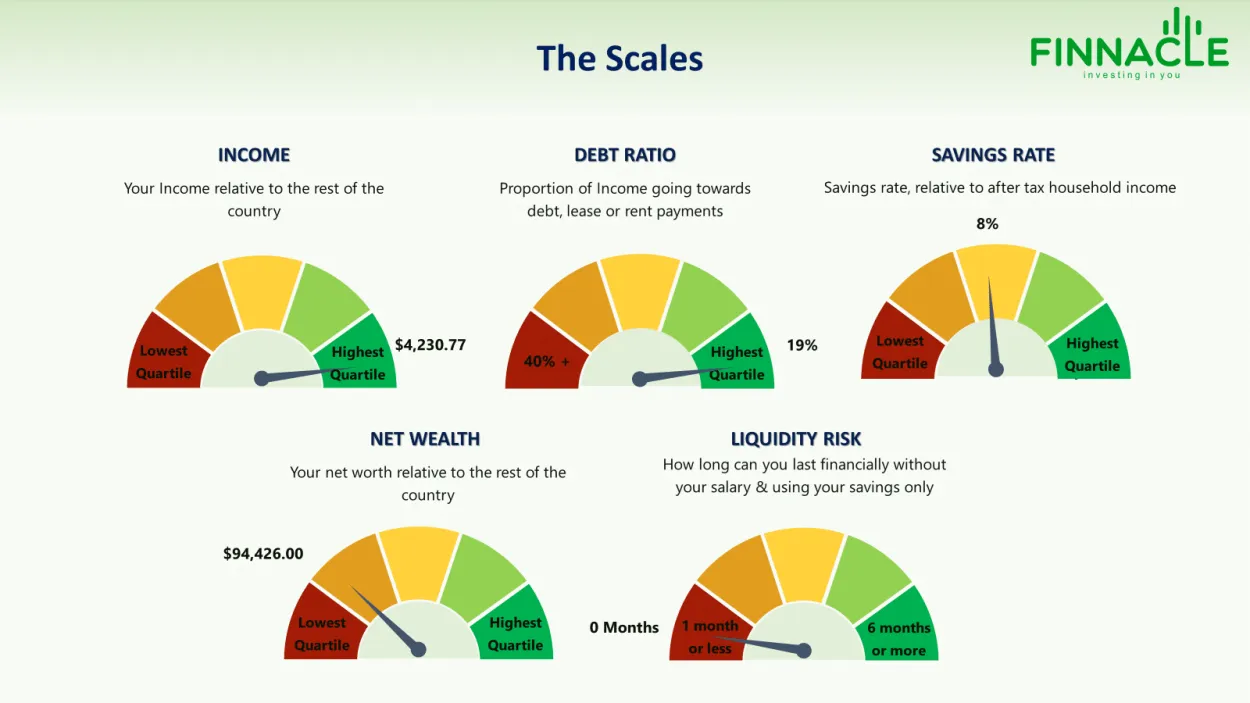

One of the key metrics to evaluate in a financial health checkup is our income and expenses. By analyzing our income sources and tracking our spending habits, we can identify areas where we can reduce expenses or increase income to achieve a better balance.

Another important metric is our debt-to-income ratio. This ratio indicates the percentage of our income that goes towards debt repayment. A high debt-to-income ratio can be a sign of financial instability, while a lower ratio indicates a healthier financial situation.

Additionally, evaluating our savings and emergency fund is crucial. Having savings for unexpected expenses and a well-funded emergency fund provides a safety net and helps prevent financial crises. It is important to regularly assess the adequacy of our savings and make adjustments accordingly.

Investments and retirement planning are also essential factors to consider in a financial health checkup. By evaluating the performance of our investments and reviewing our retirement plans, we can ensure that we are on track to meet our long-term financial goals.

In conclusion, understanding the importance of financial health and conducting regular checkups allow us to evaluate key metrics such as income and expenses, debt-to-income ratio, savings, and investments. By consistently monitoring and making necessary adjustments, we can maintain a healthy financial status, achieve our goals, and secure our future.

Assessing Liquidity Ratios for Financial Stability

Liquidity ratios are vital indicators used to evaluate a company’s financial stability. These ratios measure a company’s ability to meet short-term obligations promptly and cover current liabilities using its current assets. By analyzing liquidity ratios, investors and creditors can assess the overall health and solvency of a company. Let’s explore some key liquidity ratios to consider:

1. Current Ratio

The current ratio compares a company’s current assets to its current liabilities. It indicates whether a company has enough resources to cover its short-term obligations and is calculated by dividing current assets by current liabilities. A higher current ratio implies better liquidity and financial stability.

2. Quick Ratio

The quick ratio, also known as the acid-test ratio, is a more stringent measure than the current ratio. It excludes inventory from current assets since inventory may not be easily converted into cash. The quick ratio is calculated by deducting inventory from current assets and then dividing the result by current liabilities. A higher quick ratio indicates greater short-term liquidity.

3. Cash Ratio

The cash ratio is the most conservative liquidity ratio. It measures a company’s ability to pay off its current liabilities using only its cash and cash equivalents. By eliminating other current assets, it provides a more accurate reflection of a company’s immediate liquidity. A higher cash ratio suggests a strong ability to meet short-term obligations promptly.

Assessing a company’s liquidity ratios is essential for understanding its financial health and stability. However, it is important to note that liquidity ratios are just one part of a comprehensive financial analysis. Other factors like profitability, debt ratios, and market conditions should also be considered for a thorough evaluation.

Uncovering the Significance of Profitability Measurements

In the world of finance, conducting a financial health checkup is essential to evaluate the overall performance and stability of a company. One key aspect of this process is analyzing profitability measurements, which provide crucial insights into the company’s efficiency, growth potential, and financial standing.

Profitability measurements offer valuable information about a company’s ability to generate profits from its operations. By examining metrics such as gross profit margin, net profit margin, return on investment (ROI), and return on equity (ROE), investors and stakeholders can gauge the company’s profitability and effectiveness in utilizing its resources.

The gross profit margin indicates the percentage of revenue remaining after deducting the cost of goods sold. It reflects the efficiency of a company’s production process and pricing strategy. A higher gross profit margin signifies better control over production costs and a potentially stronger position in the market.

The net profit margin, on the other hand, provides a broader picture of a company’s profitability by considering all expenses, including operating costs, taxes, and interest. A higher net profit margin indicates better overall financial health and efficient management of expenses.

Return on investment (ROI) measures the profitability of an investment relative to its cost. It helps investors assess the potential return on their invested capital and determine whether a company’s projects or acquisitions are generating adequate returns. A higher ROI typically signifies better investment opportunities.

Return on equity (ROE) measures the profitability of a company in relation to its shareholders’ equity. It reflects the company’s ability to generate returns for its shareholders based on the equity they have invested. A higher ROE indicates efficient use of shareholder funds and sustainable profitability.

By understanding and evaluating these profitability measurements, investors and stakeholders can make informed decisions regarding investment opportunities, assess a company’s financial health, and compare it against competitors in the industry. Profitability measurements provide valuable insights that go beyond raw financial data, enabling individuals to comprehend the strengths and weaknesses of a company’s operations.

Analyzing Efficiency Indicators for Operational Performance

In the realm of financial health checkups, evaluating key metrics is crucial for businesses to maintain and improve their operational performance. One important aspect to consider is efficiency indicators, which provide crucial insights into a company’s effectiveness in utilizing its resources.

When analyzing efficiency indicators, a key metric to look at is the inventory turnover ratio. This ratio measures how quickly a company is able to sell its inventory within a given period. A high turnover ratio indicates that a company is efficiently managing its inventory and generating revenue more quickly.

Another important efficiency indicator to examine is the asset turnover ratio. This ratio assesses how effectively a company is utilizing its assets to generate sales. A higher asset turnover ratio suggests better utilization of assets and increased efficiency in generating revenue.

Furthermore, the accounts receivable turnover ratio is an essential metric to consider. It measures how efficiently a company collects cash from its customers. A higher turnover ratio indicates that the company is prompt in collecting payments, improving its cash flow and overall financial health.

Lastly, the employee productivity ratio is worth analyzing. This metric measures the efficiency of a company’s workforce by comparing its output to the number of employees. A higher productivity ratio signifies that the company is utilizing its human resources effectively, leading to higher operational performance.

By analyzing these efficiency indicators, businesses can identify areas of improvement in their operational performance. These metrics offer valuable insights into how effectively a company manages its resources, inventory, assets, and workforce. Utilizing this data, businesses can make informed decisions to enhance their financial health and overall performance.

Conclusion

Performing a financial health checkup regularly is essential to evaluate the strength of your financial situation. By monitoring key metrics such as liquidity, profitability, and solvency, you can make informed decisions and take appropriate actions to ensure financial stability and success.