In this article, we will explore the essentials of corporate tax and provide valuable insights that every business should be […]

Category: Taxes and Tax Planning

Avoiding Common Tax Mistakes: Tips and Tricks

Avoiding Common Tax Mistakes: Tips and Tricks Keeping Accurate Records When it comes to managing your taxes, one of the […]

International Tax Planning: A Guide for Global Businesses

International Tax Planning: A Guide for Global Businesses is an essential resource for companies navigating the complex world of cross-border […]

Navigating Business Taxes: A Guide for Entrepreneurs

Are you a budding entrepreneur trying to figure out the intricacies of business taxes? Look no further. In this comprehensive […]

The Impact of Tax Laws on Small Businesses

The Impact of Tax Laws on Small Businesses An Overview of Small Business Taxation Small businesses play a vital role […]

Tax Planning for Retirement: Securing Your Future

Planning for retirement is crucial in ensuring a secure future, and understanding the nuances of tax planning plays a vital […]

Understanding Tax Credits and How to Use Them

Understanding tax credits can help you maximize your savings and optimize your financial planning. In this article, we will delve […]

Estate Tax Planning: Protecting Your Legacy

Estate Tax Planning: Protecting Your Legacy Understanding Estate Taxes When it comes to estate tax planning, it is crucial to […]

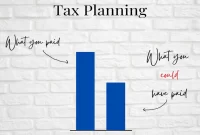

Effective Strategies for Personal Tax Planning

In today’s complex tax landscape, effective personal tax planning is essential for individuals to optimize their financial position. This article […]

Tax Deductions You Shouldn’t Miss: Maximizing Savings

Are you taking full advantage of tax deductions to maximize your savings? In this article, we will explore the top […]

- 1

- 2