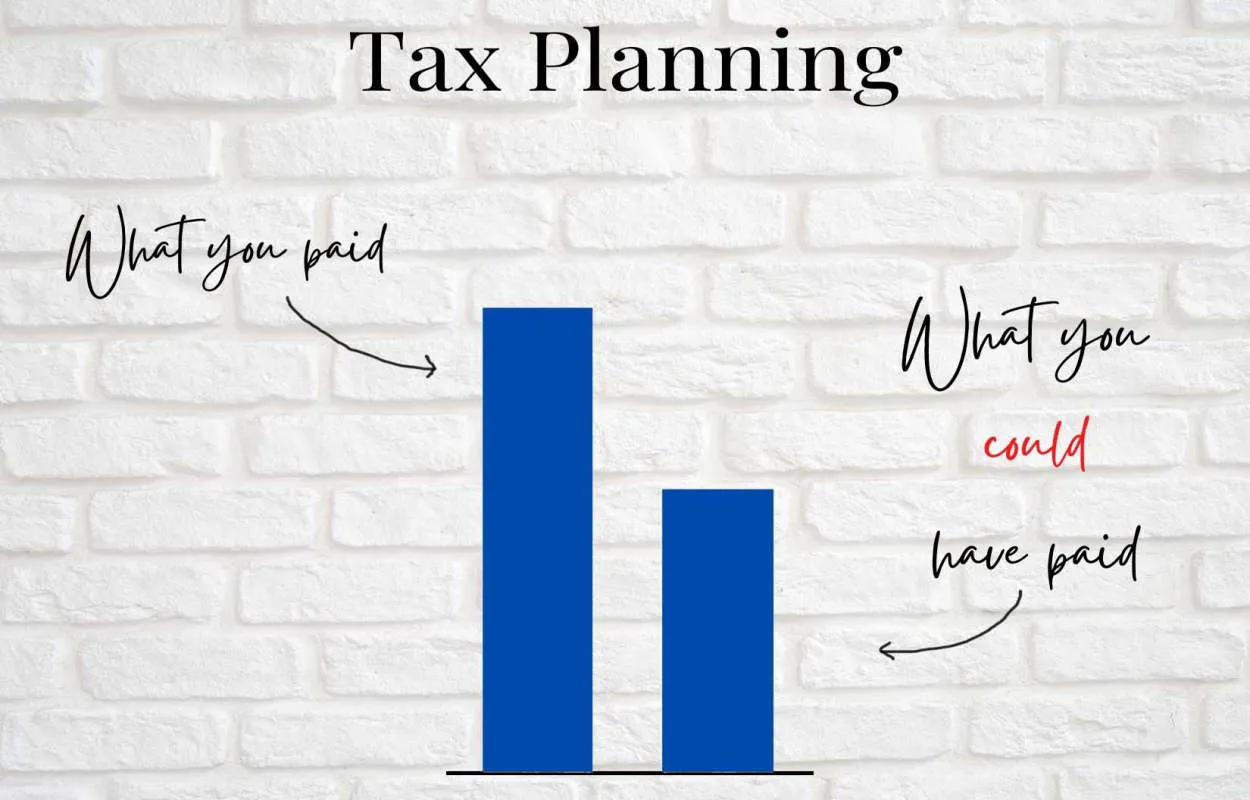

In today’s complex tax landscape, effective personal tax planning is essential for individuals to optimize their financial position. This article will explore various strategies that can help individuals make informed decisions and minimize their tax liabilities.

Overview of Personal Income Taxes

Personal income taxes are a crucial aspect of any individual’s financial planning. Understanding the basics of personal income taxes is essential for effective tax planning and optimizing one’s financial situation. This article provides an overview of personal income taxes and highlights the importance of implementing effective strategies for personal tax planning.

Personal income taxes are imposed on the income earned by an individual, including salary, wages, investment earnings, and self-employment income. The tax rates and brackets vary depending on the country and region. It is vital to stay up-to-date with the latest tax laws and regulations to ensure compliance and minimize tax liabilities effectively.

Effective tax planning strategies can help individuals reduce their overall tax burden and maximize their after-tax income. Some common strategies include:

- Taking advantage of tax deductions and credits: By identifying eligible deductions and credits, individuals can decrease their taxable income and potentially receive tax benefits. Examples include mortgage interest deductions, education expenses, and charitable contributions.

- Utilizing tax-advantaged retirement savings: Contributing to retirement accounts such as 401(k)s or Individual Retirement Accounts (IRAs) can provide immediate tax benefits, such as tax-deductible contributions or tax-free growth. These accounts allow individuals to save for the future while also reducing their current tax liability.

- Implementing tax-efficient investment strategies: Making informed investment decisions, such as utilizing tax-efficient investment vehicles or holding investments for the long term, can help minimize the impact of capital gains taxes.

- Timing income and expenses: Individuals can strategically time their income and expenses to optimize their tax situation. For example, deferring income to a future year or accelerating deductible expenses into the current year may result in lower overall taxes.

In conclusion, having a comprehensive understanding of personal income taxes and implementing effective tax planning strategies are essential for maximizing one’s financial well-being. By staying informed, leveraging available tax benefits, and employing strategic approaches, individuals can proactively manage their personal income taxes and achieve their financial goals.

Maximizing Deductions and Tax Credits

When it comes to personal tax planning, employing effective strategies to maximize deductions and tax credits is crucial. By taking advantage of every available opportunity to reduce your taxable income and claim credits, you can potentially lower your overall tax liability. Here are some key strategies to consider:

1. Itemize Your Deductions

Instead of taking the standard deduction, itemizing your deductions can potentially lead to a higher deduction amount. Carefully review eligible expenses, such as mortgage interest, state and local taxes, medical expenses, and charitable contributions, to determine if itemizing will result in greater tax savings.

2. Maximize Retirement Contributions

Contributing to retirement accounts, such as a 401(k) or an individual retirement account (IRA), not only helps secure your financial future but also offers potential tax advantages. Contributions made to certain retirement accounts may be tax-deductible or grow tax-free until withdrawn.

3. Leverage Education-Related Tax Benefits

If you or your dependents are pursuing higher education, be sure to explore education-related tax benefits. The American Opportunity Credit and the Lifetime Learning Credit can help offset qualified education expenses, reducing your tax burden.

4. Take Advantage of Tax-Advantaged Accounts

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can provide significant tax advantages for eligible expenses. Contributions to HSAs can be deducted from your taxable income, while FSAs allow you to set aside pre-tax dollars for medical and dependent care expenses.

5. Stay Updated on Tax Law Changes

Tax laws are subject to change, and staying informed about updates can help you take advantage of new deductions and credits. Follow reliable sources, consult with a tax professional, or use reputable tax software to ensure you are aware of any changes that may impact your tax planning strategies.

By implementing these effective strategies, you can optimize your personal tax planning and potentially achieve significant tax savings. However, it’s important to consult with a tax advisor or certified professional to ensure you understand the specific deductions and credits applicable to your individual circumstances.

Investment Strategies for Tax Efficiency

When it comes to personal tax planning, considering investment strategies that can help enhance tax efficiency is crucial. By making smart investment decisions and leveraging various tax planning tools, individuals can minimize their tax obligations and potentially maximize their after-tax returns. Here are some effective strategies to consider:

1. Tax-Advantaged Accounts

One of the key investment strategies for tax efficiency is to take advantage of tax-advantaged accounts such as individual retirement accounts (IRAs) and 401(k) plans. Contributions to these accounts are typically tax-deductible, and the investments grow tax-deferred until withdrawn in retirement. Utilizing these accounts not only helps in reducing current taxable income but also allows for potential tax-free compounding over the long term.

2. Tax-Efficient Asset Allocation

Another crucial aspect of tax-efficient investing is determining the right asset allocation. By strategically allocating investments across different types of accounts, such as taxable brokerage accounts, tax-deferred accounts, and tax-free accounts, individuals can minimize their overall tax liability. Generally, it is advisable to place tax-efficient investments, such as index funds or tax-managed funds, in taxable accounts, while holding tax-inefficient investments, like taxable bonds, in tax-advantaged accounts.

3. Tax-Loss Harvesting

Tax-loss harvesting is a strategy that involves selling investments that have experienced a decline in value to offset capital gains realized from other investments. By strategically harvesting tax losses, individuals can reduce their taxable income and potentially offset their capital gains tax liability. It is important to consider the wash-sale rule, which prohibits repurchasing the same or substantially identical investments within 30 days of the sale to claim the tax loss.

4. Charitable Giving

Engaging in charitable giving not only allows individuals to support causes they care about but also presents an opportunity for tax planning. By donating appreciated assets, such as stocks or mutual funds held for more than one year, individuals can potentially avoid capital gains tax on the appreciation while claiming a tax deduction for the fair market value of the donated assets. This strategy can help reduce taxable income while making a positive impact.

5. Asset Location

Asset location refers to the strategic placement of investments in specific types of accounts to minimize taxes. This strategy involves considering the tax implications of different investments and allocating them accordingly. Generally, tax-efficient investments that generate long-term capital gains or qualified dividends are better suited for taxable accounts, while fixed income investments that generate ordinary income are more appropriate for tax-deferred accounts.

By implementing these investment strategies for tax efficiency, individuals can effectively reduce their tax burden and potentially achieve better after-tax investment returns. However, it is essential to consult with a qualified tax advisor or financial planner to ensure that these strategies align with specific financial goals and objectives.

Planning for Retirement and Minimizing Taxes

When it comes to personal finance, planning for retirement and minimizing taxes are two key considerations. Proper planning can ensure that individuals maximize their savings for retirement while minimizing their tax liabilities. Here are some effective strategies to achieve these goals:

1. Maximize Contributions to Retirement Accounts

Contributing to retirement accounts such as 401(k)s or IRAs can provide individuals with tax advantages. By maximizing contributions, individuals can take advantage of potential tax deductions and tax-free growth on their investments, leading to greater savings over time.

2. Take Advantage of Employer Matching

If your employer offers a retirement savings plan with a matching contribution, it is crucial to take full advantage of this benefit. Employer matches are essentially free money and can significantly boost your retirement savings. Be sure to contribute enough to receive the maximum employer match.

3. Consider Roth Options

Roth retirement accounts, such as Roth IRAs or Roth 401(k)s, allow individuals to contribute after-tax dollars. While contributions to Roth accounts are not tax-deductible, withdrawals in retirement are tax-free. This can be advantageous for individuals who expect to be in a higher tax bracket during retirement.

4. Utilize Tax-Advantaged Investments

Investing in tax-advantaged vehicles such as municipal bonds or tax-efficient mutual funds can help minimize your tax burden. These investments may generate income that is tax-exempt or subject to lower tax rates, ultimately increasing your after-tax returns.

5. Diversify Retirement Income Sources

Relying solely on traditional retirement accounts may lead to a higher tax bill during retirement. By diversifying your income sources, such as incorporating taxable investments or rental properties, you can potentially manage your tax liabilities more effectively and maximize your after-tax income.

6. Stay Informed and Seek Professional Advice

Tax laws and retirement planning strategies can change over time. It is crucial to stay informed about updates in tax legislation and seek professional advice from a certified financial planner or tax advisor. They can provide personalized guidance and ensure you are making the most of available tax-saving opportunities.

Implementing effective strategies for personal tax planning and retirement can have a significant impact on your financial well-being in the long run. By utilizing these strategies and staying proactive, you can make the most of your retirement savings while minimizing your tax burden.

Conclusion

In conclusion, implementing effective strategies for personal tax planning is crucial for individuals seeking to optimize their financial situation. By understanding relevant tax laws, taking advantage of deductions and credits, and seeking professional advice when necessary, individuals can minimize their tax liabilities and maximize their wealth accumulation. By prioritizing tax planning, individuals can ensure they are making informed financial decisions and making the most of available opportunities to reduce their tax burden.