Are you unsure whether a credit union or a bank is the right financial institution for you? In this article, we’ll explore the key differences between the two and help you determine which one suits your needs best.

What is a Credit Union?

A credit union is a financial institution that is owned and operated by its members, who are also its customers. It is a non-profit organization that provides various financial services such as savings accounts, checking accounts, loans, and credit cards.

Unlike banks, which are for-profit entities owned by shareholders, credit unions are member-focused and aim to provide benefits to their members rather than to make a profit. This means that any earnings made by a credit union are reinvested back into the organization or passed on to its members in the form of lower fees, higher interest rates on savings accounts, or lower interest rates on loans.

Credit unions often have a specific common bond among their members, such as working for the same employer, belonging to a certain community, or being part of a specific organization. This common bond helps foster a sense of community and allows credit unions to offer personalized service and products tailored to the specific needs of their members.

However, credit unions may have a more limited scope in terms of branch and ATM networks compared to banks. They may also have fewer digital banking features. Nevertheless, credit unions are known for their excellent customer service, competitive rates, and a strong focus on member satisfaction.

How Do Credit Unions Differ from Banks?

When considering where to keep your money and manage your financial needs, it’s important to understand the differences between credit unions and banks. While they both offer similar services, there are some key distinctions that can help you make the right choice for your financial goals.

Credit Unions:

Credit unions are not-for-profit organizations owned by their members, who are typically individuals sharing a common bond, such as a workplace, community, or interest group. Here are some of the key characteristics of credit unions:

- <strong.membership requirements: Credit unions have specific membership criteria that you must meet in order to join and become a member. This can include residing in a certain area or belonging to a particular organization.

- <strong.customer-focused: Credit unions prioritize their members’ needs and aim to provide personalized service. As member-owned institutions, they work for the benefit of their members rather than shareholders.</strong.customer-focused:

- <strong.fees and="" rates: Credit unions generally offer lower fees and better interest rates on loans and savings accounts compared to banks. This is because any profits made are reinvested back into the credit union to benefit its members.

Banks:

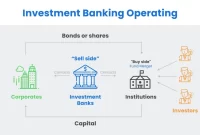

Banks, on the other hand, are for-profit institutions that provide financial services to individuals, businesses, and organizations. Here are some key characteristics of banks:

- <strong.accessibility: Banks typically have a larger network of branches and ATMs, making them more accessible in various locations.</strong.accessibility:

- <strong.diverse product="" offerings: Banks often offer a wide range of products, including credit cards, mortgages, investment options, and business services.

- <strong.shareholder-driven: Banks are driven by profits and aim to maximize returns for their shareholders.</strong.shareholder-driven:

When deciding between a credit union and a bank, consider your specific financial needs, the level of personalized service you desire, and the accessibility of banking services in your area. By understanding these differences, you can choose the financial institution that aligns best with your goals.

Advantages of Credit Unions

Credit unions offer several advantages over traditional banks. Here are some key benefits of choosing a credit union:

- Lower fees: Credit unions often have lower fees compared to banks. They prioritize providing affordable services to their members.

- Better interest rates: Credit unions typically offer higher interest rates on savings accounts and lower rates on loans and credit cards.

- Member-centric approach: Credit unions are not-for-profit organizations owned by their members. This means they prioritize serving their members’ interests rather than generating profits for shareholders.

- Personalized service: Credit unions focus on building strong relationships with their members. They often provide personalized assistance and guidance in managing finances.

- Community involvement: Credit unions prioritize giving back to the community. They often support local initiatives and charities.

- Democratic decision-making: As a member of a credit union, you have the right to participate in the decision-making process. Each member has a say in electing the board of directors.

Consider these advantages when deciding between a credit union and a traditional bank. Assess your financial needs and preferences to make an informed decision.

Factors to Consider When Choosing Between a Credit Union and a Bank

When deciding between a credit union and a bank, several factors should be taken into consideration to make an informed choice that suits your specific banking needs.

1. Membership Requirements

Credit unions usually have membership requirements, such as being part of a specific community or belonging to a particular organization. Banks, on the other hand, are generally open to anyone who meets their criteria. Consider whether you meet the eligibility criteria of a credit union before deciding.

2. Ownership and Governance

Credit unions are member-owned and operated, while banks are typically owned by shareholders. If you prefer a more community-oriented approach, where members have a say in decision-making processes, a credit union might be the right choice. Banks, on the other hand, are typically focused on maximizing profits for their shareholders.

3. Services and Products

Compare the range of services and products offered by credit unions and banks. While both institutions provide basic banking services such as checking and savings accounts, loans, and credit cards, credit unions often offer more personalized customer service and lower interest rates on loans and credit cards.

4. Branch and ATM Access

Consider the convenience of branch and ATM access. Banks typically have a larger network of branches and ATMs, making it easier to access your accounts. Credit unions may have more limited branch and ATM locations, which could be a factor if you prefer face-to-face interactions for your banking needs.

5. Fees and Rates

Compare the fees and rates charged by credit unions and banks. Credit unions often have lower fees, higher interest rates on savings accounts, and lower interest rates on loans compared to banks. Analyze your financial situation and banking habits to determine which option will be more cost-effective for you.

In conclusion, when choosing between a credit union and a bank, it is essential to consider factors such as membership requirements, ownership and governance, services and products, branch and ATM access, as well as fees and rates. Each individual’s banking needs will vary, so consider these factors to make an informed decision that aligns with your preferences.

Conclusion

In conclusion, whether a credit union or a bank is right for you depends on your specific financial needs and preferences. Credit unions offer a more personalized and member-focused approach, along with potential cost savings and higher interest rates on savings accounts. On the other hand, banks provide a wider range of services, more advanced technology, and greater accessibility. Consider your priorities and goals before making a decision.