Diversifying Your Investment Portfolio: A Practical Approach

The Importance of Portfolio Diversification

Diversifying Your Investment Portfolio: A Practical Approach

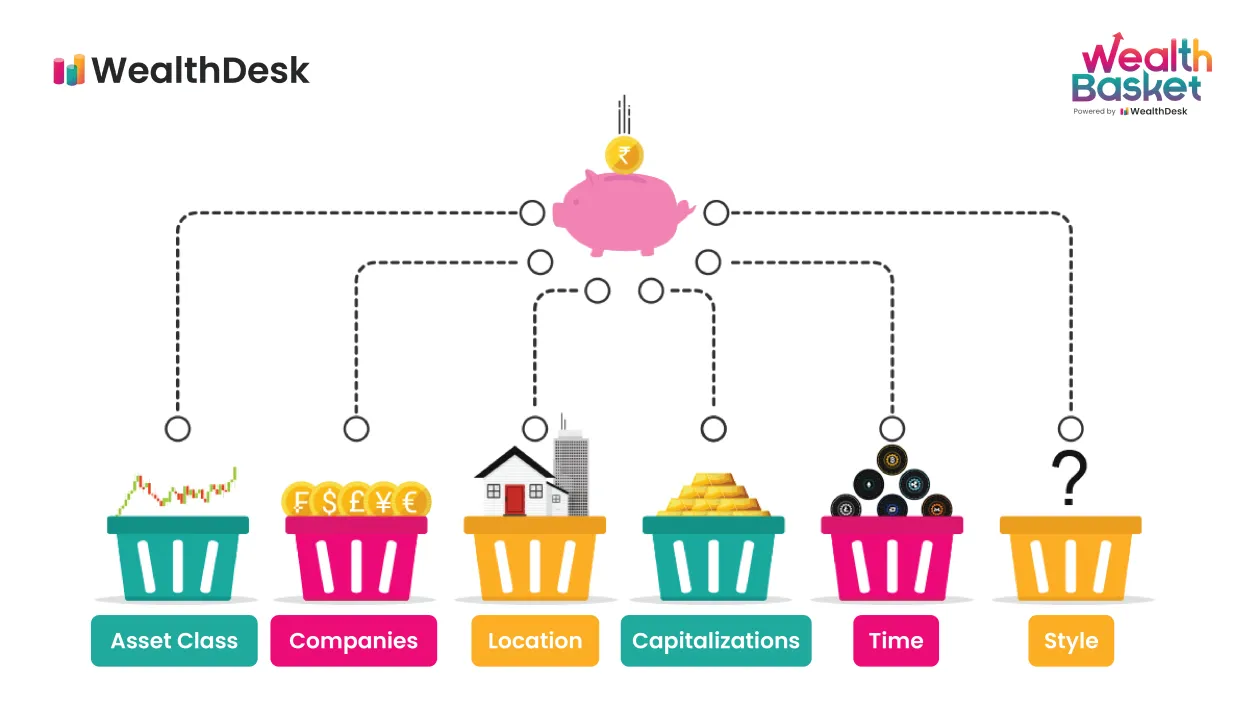

When it comes to investing, one of the most crucial strategies to implement is portfolio diversification. This process involves spreading your investments across various asset classes, industries, and geographical regions. By doing so, you can reduce the risk and increase the potential for long-term returns.

Minimizing Risk

Portfolio diversification helps minimize the impact of sudden market fluctuations on your investments. When one sector or asset class underperforms, the others may thrive, offsetting potential losses. By having a diversified portfolio, you can effectively protect your investments from significant downturns.

Maximizing Returns

Diversification allows you to capture potential growth opportunities across different areas. For example, by investing in a mix of stocks, bonds, real estate, and commodities, you can benefit from the growth potential of multiple sectors. While some investments may have slower growth, others can deliver higher returns, balancing your overall portfolio performance.

Reducing Volatility

A well-diversified portfolio typically experiences lower volatility compared to one that is concentrated. When certain assets are skyrocketing in value, others may remain stable or decline. This helps smooth out the ups and downs and provides a more stable investment journey.

Long-Term Planning

Portfolio diversification is a long-term approach that aims to achieve steady and sustained growth. By diversifying your investments, you reduce the reliance on any single asset or company for your overall portfolio performance. This approach helps protect you from the negative impacts of economic recessions, industry-specific downturns, or company failures.

Conclusion

In conclusion, the importance of portfolio diversification cannot be overstated. It not only minimizes risk and maximizes returns but also reduces volatility and provides a solid foundation for long-term financial planning. By implementing a well-diversified investment strategy, you can set yourself up for greater success in reaching your financial goals.

Identifying Different Investment Vehicles

When it comes to diversifying your investment portfolio, it is important to understand the various investment vehicles available to you. Each investment vehicle comes with its own set of characteristics, risks, and potential returns. By identifying and understanding these different investment vehicles, you can make informed decisions about how to allocate your funds.

1. Stocks

Stocks represent ownership in a company and can be purchased on stock exchanges. They offer potential long-term growth and the opportunity to earn dividends. However, stocks also come with the risk of price volatility and the potential for loss.

2. Bonds

Bonds are debt instruments issued by governments, municipalities, and corporations. They provide fixed interest payments over a specified period and return the principal upon maturity. Bonds are generally considered less volatile than stocks but offer lower potential returns.

3. Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professionals and offer diversification, liquidity, and convenience. However, mutual funds charge fees that can eat into investment returns.

4. Real Estate

Real estate investments can include residential properties, commercial properties, and real estate investment trusts (REITs). They offer the potential for rental income and capital appreciation. However, real estate investments require ongoing maintenance and can be illiquid.

5. Commodities

Commodities include tangible goods like gold, oil, and agricultural products. They offer a hedge against inflation and can diversify a portfolio. However, commodity prices can be volatile and affected by factors such as supply and demand.

6. Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification, flexibility, and often lower fees compared to mutual funds. However, they can also be subject to price volatility.

By understanding the characteristics and risks of different investment vehicles like stocks, bonds, mutual funds, real estate, commodities, and ETFs, you can develop a well-diversified investment portfolio that aligns with your financial goals and risk tolerance.

Balancing Risk and Return through Asset Allocation

In the world of investing, finding the right balance between risk and return is crucial for achieving long-term financial goals. Asset allocation is a practical approach that can help investors diversify their investment portfolios to achieve this balance effectively.

Asset allocation involves spreading investments across different asset classes such as stocks, bonds, cash, and real estate, with the goal of optimizing returns while managing risk. By diversifying investments, investors can reduce the impact of any single investment’s performance on their overall portfolio.

One essential factor to consider when determining asset allocation is risk tolerance. Investors must assess their willingness and ability to tolerate fluctuations in the value of their investments. A higher-risk tolerance investor may allocate a larger portion of their portfolio to stocks, which historically have higher returns but also higher volatility. On the other hand, a more risk-averse investor may choose to allocate a larger percentage of their portfolio to less volatile assets like bonds or cash.

Another crucial consideration is the investor’s investment timeline. Generally, longer-term goals allow for a more aggressive asset allocation, as there is more time to recover from any market downturns. For shorter-term goals, a more conservative approach with a higher allocation to low-risk assets may be appropriate.

Asset allocation is not a one-time decision. It requires regular review and adjustments to ensure it remains aligned with an investor’s changing financial circumstances, goals, and risk tolerance. Periodic rebalancing can help maintain the desired asset mix and prevent the portfolio from becoming too heavily weighted towards one specific asset class.

In conclusion, diversifying your investment portfolio through asset allocation is a practical approach to balance risk and return. By spreading investments across various asset classes and monitoring the allocation over time, investors can minimize risk and maximize the potential for returns, ultimately increasing their chances of achieving their financial objectives.

Implementing a Diversification Strategy

Diversifying your investment portfolio is an essential strategy for minimizing risk and maximizing returns. By spreading your investments across different asset classes, sectors, and geographic locations, you can reduce the impact of any single investment on your overall portfolio performance. Here are some practical steps to help you implement a diversification strategy:

-

Set clear investment goals:

Before diversifying your portfolio, define your financial objectives, time horizon, and risk tolerance. This will guide your investment decisions and help you determine the level of diversification needed.

-

Analyze and understand your current portfolio:

Assess your existing investments to identify any gaps or concentration risks. Evaluate the percentage of each asset class, sector, or individual stock to determine potential areas for diversification.

-

Allocate assets across different classes:

Allocate your investments across various asset classes such as stocks, bonds, real estate, and commodities. Each asset class behaves differently and has unique risk and return characteristics. Diversifying across classes can reduce the impact of volatility in any single market.

-

Consider geographical diversification:

Expand your investments internationally to reduce exposure to any one country’s economic or political events. Investing in different regions can offer opportunities in emerging markets and protect against downturns in specific economies.

-

Diversify within asset classes:

Within each asset class, diversify further by investing in different sectors. For example, in the stock market, consider investing in various industries like technology, healthcare, and consumer goods. This will help mitigate risks associated with a particular sector’s performance.

-

Monitor and rebalance your portfolio:

Regularly review your portfolio’s performance and make necessary adjustments. Rebalancing ensures that your investments stay aligned with your desired diversification levels and helps you capitalize on changing market conditions.

By implementing a diversification strategy, you can build a resilient investment portfolio that can weather different market conditions. However, keep in mind that diversification does not guarantee profits or protect against losses, but it can play a crucial role in managing risk and enhancing potential returns.

Conclusion

Diversifying your investment portfolio is a practical approach to reducing risk and maximizing returns. By spreading your investments across different assets, sectors, and geographical regions, you can minimize the impact of market fluctuations and increase the chances of capturing profitable opportunities. Whether you choose stocks, bonds, real estate, or alternative investments, it is important to carefully analyze and monitor your portfolio to ensure it aligns with your financial goals and risk tolerance. Remember, diversification is a key strategy for building long-term wealth and protecting your investments.