International Tax Planning: A Guide for Global Businesses is an essential resource for companies navigating the complex world of cross-border taxes. This article explores key strategies and considerations to optimize tax efficiency, mitigate risks, and ensure compliance in an increasingly globalized marketplace.

An Introduction to International Taxation

International taxation is a crucial aspect of global business operations. It involves understanding and managing the tax implications of cross-border transactions, investments, and operations. In an increasingly interconnected world, businesses need to navigate the complexities of international tax laws to ensure compliance and optimize their tax positions.

International tax planning plays a vital role in helping global businesses minimize their tax burden while maximizing their profits. It involves strategizing and structuring business activities across different countries to take advantage of favorable tax jurisdictions, incentives, and treaties.

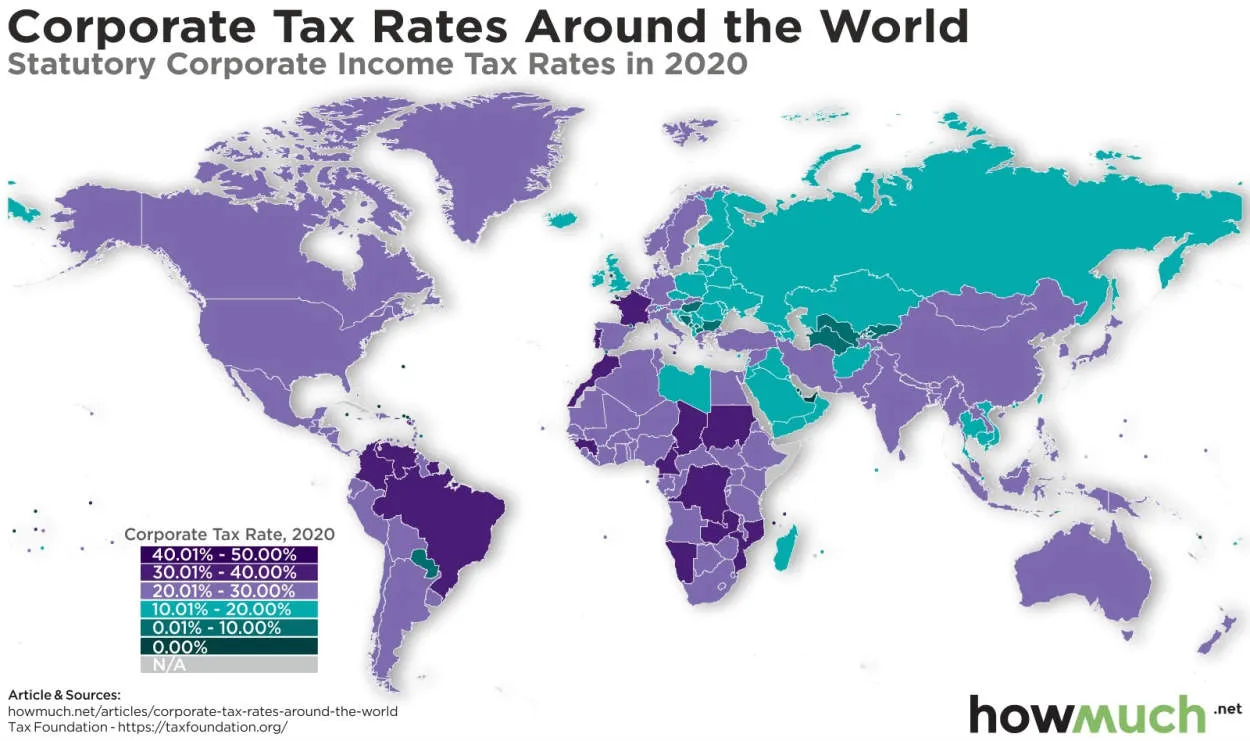

Key considerations in international tax planning include understanding the various types of taxes that may apply, such as corporate income tax, withholding tax, value-added tax (VAT), and transfer pricing rules. It also involves analyzing the potential risks and benefits of different tax structures, including the use of tax havens, holding companies, and intercompany transactions.

Furthermore, staying abreast of international tax developments and changes in tax regulations is crucial for businesses engaged in global operations. They must remain compliant with tax laws and regulations in multiple jurisdictions, which can be complex and time-consuming.

In summary, international taxation is a vital consideration for global businesses. Effective international tax planning can help businesses optimize their tax positions, minimize risks, and ensure regulatory compliance. By understanding the foundations of international taxation and working with knowledgeable tax professionals, businesses can navigate the complexities and leverage tax opportunities in an increasingly global marketplace.

Key Considerations for Global Tax Planning

When it comes to international tax planning for global businesses, there are several important factors that need to be taken into consideration:

- Double Taxation: One of the key challenges in global tax planning is to avoid or minimize the risk of double taxation. This can be achieved through tax treaties, transfer pricing strategies, and utilizing tax credits or exemptions.

- Local Tax Laws: Understanding the tax laws and regulations of different countries is crucial. Each country has its own tax system, rates, and compliance requirements. Businesses need to stay informed and ensure compliance to avoid penalties or legal issues.

- Transfer Pricing: Transfer pricing refers to the pricing of goods, services, or intellectual property transferred between related entities in different countries. Managing transfer pricing effectively is important to avoid tax authorities scrutinizing transactions and potentially imposing penalties.

- Permanent Establishment: Establishing a permanent establishment (PE) in a foreign country can have significant tax implications. It is essential to carefully assess the PE criteria in different jurisdictions to determine the tax liabilities and obligations that may arise.

- Tax Incentives: Many countries offer tax incentives or exemptions to attract foreign investment. Businesses should explore these opportunities and leverage them to optimize their global tax planning strategies.

- Compliance and Reporting: Meeting tax compliance requirements and maintaining accurate records is crucial in global tax planning. Businesses should ensure proper documentation and reporting to avoid penalties, audits, and reputational damage.

Global tax planning can be complex and requires in-depth knowledge of international tax laws. By considering these key factors and working with tax professionals, global businesses can develop effective tax strategies and minimize their tax liabilities while staying compliant.

Double Taxation Treaties

Double Taxation Treaties, also known as Double Taxation Agreements (DTAs), are bilateral agreements signed between two countries to eliminate or minimize the potential double taxation of income or capital gains for individuals and businesses operating in both countries.

These treaties aim to promote international trade and investment by providing clarity and certainty on the tax obligations of taxpayers conducting cross-border activities. They help prevent situations where income or profits could be subject to taxation in both the country of residence and the country where the income is generated.

Typically, Double Taxation Treaties define the rules for determining tax residency, allocate taxing rights over different types of income (such as dividends, interest, royalties, and capital gains), and establish procedures for resolving disputes between tax authorities.

Global businesses can benefit from Double Taxation Treaties as they provide various advantages, including:

- Reducing or eliminating double taxation, which preserves profitability and encourages international business expansion.

- Providing tax certainty and predictability, enabling businesses to plan their operations and investments more effectively.

- Preventing tax evasion and promoting transparency through the exchange of information between tax authorities.

It is important for global businesses to understand the specific provisions of Double Taxation Treaties applicable to their operations to optimize their tax planning strategies and ensure compliance with the tax laws of the countries involved.

Structuring International Business Operations

Structuring international business operations is essential for global businesses to effectively manage their operations and ensure compliance with international tax regulations. In this article, we will provide a comprehensive guide to international tax planning, highlighting key considerations and strategies for success.

1. Understand the International Tax Landscape

Before engaging in international business operations, it is crucial to have a thorough understanding of the international tax landscape. Different countries have different tax laws and regulations, making it essential to research and stay updated on applicable tax treaties, transfer pricing rules, and foreign tax credit provisions.

2. Establish an Efficient International Tax Structure

Creating an efficient international tax structure is vital for minimizing tax liabilities and optimizing profits. Determine the ideal legal and operational structure for your business, taking into account factors such as the nature of your operations, tax rates, and potential tax incentives available in different jurisdictions.

3. Conduct Transfer Pricing Analysis

Transfer pricing refers to the pricing of goods, services, or intellectual property transferred between related entities in different tax jurisdictions. It is vital to conduct a transfer pricing analysis to ensure transactions are priced at arm’s length and comply with local transfer pricing regulations.

4. Leverage Double Tax Treaties

Double tax treaties are bilateral agreements between countries that aim to eliminate double taxation and prevent tax evasion. Understanding and utilizing these treaties can provide substantial tax benefits, including reduced withholding tax rates and avoiding double taxation on income earned in multiple jurisdictions.

5. Implement Effective Tax Planning Strategies

Global businesses should consider implementing various tax planning strategies to minimize their overall tax burden. This may include utilizing tax incentives and exemptions, structuring intercompany transactions efficiently, utilizing tax-efficient jurisdictions, and conducting thorough tax risk assessments.

6. Maintain Compliance with Global Tax Regulations

Staying compliant with global tax regulations is crucial to avoid penalties and reputational damage. Regularly review and update your international tax strategy to ensure ongoing compliance with local tax laws, reporting requirements, and transfer pricing documentation.

7. Seek Professional Advice

Given the complexity of international tax planning, it is highly recommended to seek professional advice from tax experts and consultants specializing in international taxation. They can provide tailored strategies, help navigate legal complexities, and ensure your business operates in a tax-efficient manner.

By effectively structuring international business operations and implementing sound international tax planning strategies, global businesses can optimize their tax position, minimize risks, and achieve sustainable growth in the global marketplace.

Conclusion

International tax planning is essential for global businesses to navigate the complexities of cross-border taxation and ensure compliance with the relevant laws and regulations. By carefully strategizing and optimizing their tax structures, businesses can minimize tax liabilities, maximize profits, and enhance their competitiveness in the global marketplace.