The future of digital banking is evolving rapidly, with new trends and predictions shaping the industry. From the rise of mobile banking to the incorporation of artificial intelligence and blockchain technology, this article delves into the latest developments that are set to revolutionize the way we bank.

Exploring the Rise of Digital Banking and Its Impact on Traditional Banking

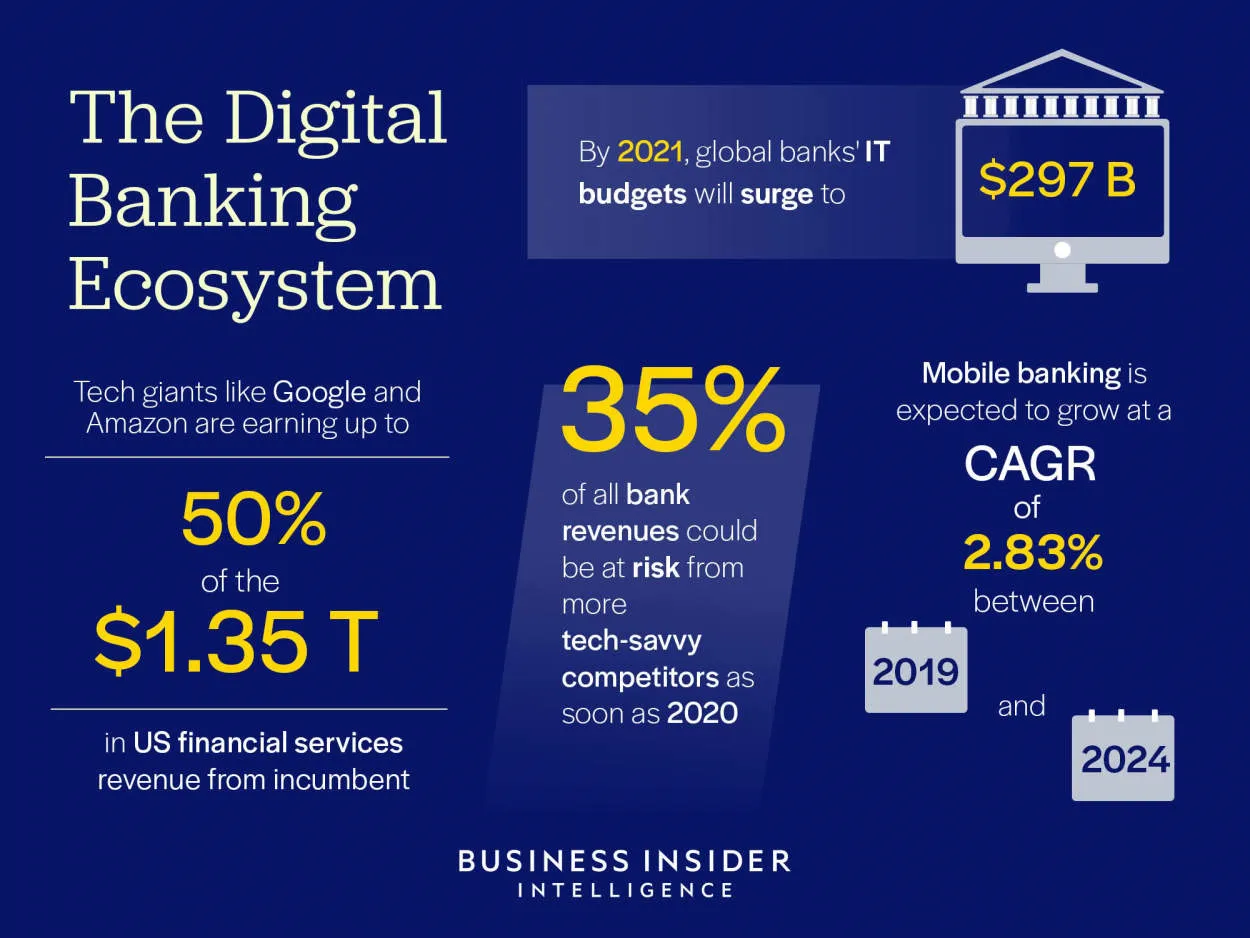

The future of digital banking is rapidly evolving, transforming the way we manage our finances and disrupting the traditional banking sector. With advancements in technology, mobile banking apps, online services, and digital payment systems are becoming increasingly popular.

One of the key trends in digital banking is the convenience it offers. Consumers can now access their accounts, make transactions, and even apply for loans from the comfort of their homes. This has greatly improved user experience and eliminated the need for physical visits to the bank.

Another major impact is the reduction of operational costs for banks. With the shift towards digital platforms, banks can automate various processes and streamline operations, resulting in greater efficiency and scalability.

The rise of digital banking has also fueled the growth of fintech companies. These agile startups are harnessing technology to offer innovative financial products and services, often with lower fees and a more personalized approach than traditional banks.

However, it is important to note that digital banking is not without risks. With an increased reliance on technology, cybersecurity becomes a significant concern. Banks must invest heavily in robust security measures to safeguard customer data and prevent fraud.

Looking ahead, the future of digital banking holds many exciting possibilities. Artificial Intelligence (AI), machine learning, and big data analytics will revolutionize how banks understand and cater to customer needs. Additionally, the emergence of blockchain technology may enable secure and transparent transactions, further enhancing the banking experience.

In conclusion, the rise of digital banking is reshaping the financial landscape, impacting traditional banking practices in profound ways. As technology continues to advance, it is crucial for banks to adapt and embrace the digital revolution to stay competitive in the ever-evolving industry.

The Role of Artificial Intelligence and Machine Learning in Digital Banking

Artificial Intelligence (AI) and Machine Learning (ML) have become crucial elements in the evolution of digital banking. With the advancements in technology, AI and ML are transforming the way banking institutions operate and deliver services to their customers.

One of the main roles of AI and ML in digital banking is enhancing customer experience. Through AI-powered chatbots and virtual assistants, banks can provide quick and personalized assistance to their customers, improving overall satisfaction and engagement.

Moreover, AI and ML algorithms can also be utilized to detect and prevent fraudulent activities. These technologies have the ability to analyze vast amounts of data in real-time, identifying patterns and anomalies that may indicate fraudulent transactions. By doing so, banks can enhance the security of their systems and protect their customers from potential threats.

Additionally, AI and ML algorithms enable banks to streamline their processes and make faster and more accurate decisions. For instance, these technologies can automate tasks such as loan approvals, risk assessment, and customer segmentation, reducing human error and saving time.

Furthermore, AI and ML play a crucial role in data analysis and predictive modeling. By analyzing customer data, banks can gain valuable insights into customer behavior and preferences. These insights can be used to develop personalized marketing campaigns and product recommendations, ultimately increasing customer engagement and loyalty.

In conclusion, the role of Artificial Intelligence and Machine Learning in digital banking is significant and multifaceted. From enhancing customer experience to improving security and efficiency, these technologies are reshaping the future of banking. As AI and ML continue to advance, we can expect even more innovative solutions and transformative changes in the digital banking landscape.

Enhanced Security Measures in Digital Banking: Addressing Concerns and Challenges

In today’s rapidly advancing digital era, the future of banking lies in the realm of digital solutions. As the popularity of digital banking grows, so does the concern over security. To ensure safe financial transactions and protect sensitive user data, enhanced security measures are essential.

One of the major concerns in digital banking is the risk of cybersecurity threats. Banks and financial institutions are continuously improving their security systems to combat hacking, data breaches, and identity theft. Robust firewalls, encryption protocols, and multi-factor authentication are now becoming standard practices.

The adoption of biometric authentication methods, such as fingerprint or facial recognition, adds an extra layer of security. These technologies are more secure and convenient, as they rely on unique biological traits that are difficult to replicate or forge.

Another challenge in digital banking is the rise of phishing attacks and social engineering scams. To address this issue, banks invest in educational campaigns to raise awareness among customers. Additionally, they implement advanced fraud detection systems to identify suspicious activities and block unauthorized transactions.

Continuous monitoring and analysis of customer behavior patterns also help in identifying potential security breaches. Machine learning algorithms can detect abnormal activities and promptly alert both the bank and the customer, enabling quick action to prevent any potential threats.

Moreover, banks are increasingly collaborating with technology firms to implement enhanced security measures. Artificial intelligence and big data analytics play a significant role in identifying and mitigating threats in real-time. By leveraging these technologies, banks can swiftly respond to security incidents and protect their customers’ interests.

To ensure the future of digital banking remains secure, it is crucial to establish industry-wide standards and regulations. Collaborative efforts among banks, government agencies, and cybersecurity experts are essential to address evolving threats and stay ahead of cybercriminals.

Blockchain and Cryptocurrency Revolutionizing the Banking Industry

The banking industry is undergoing a significant transformation due to the revolutionary technologies of blockchain and cryptocurrency. These advancements are reshaping the future of digital banking, creating new opportunities and challenges for financial institutions worldwide.

One of the key benefits of blockchain technology is its ability to provide a decentralized and transparent system for recording and verifying transactions. By using a distributed ledger system, banks can streamline their operations, reduce costs, and enhance security. This technology eliminates the need for intermediaries, making transactions faster and more efficient.

Cryptocurrencies, on the other hand, are digital currencies that operate on blockchain networks. They are gaining traction as an alternative to traditional fiat currencies, offering benefits such as fast cross-border transfers, lower fees, and increased privacy. Financial institutions are exploring ways to integrate cryptocurrencies into their services, allowing customers to make digital transactions seamlessly.

Furthermore, the use of smart contracts powered by blockchain technology is revolutionizing banking processes. Smart contracts are self-executing contracts with predefined rules embedded in their code. They enable automatic payments, reduce paperwork, and eliminate the need for intermediaries, revolutionizing loan approvals, trade finance, and insurance claims.

The rise of blockchain also opens up new possibilities for financial inclusion. With traditional banking services often inaccessible to the unbanked population, blockchain technology allows individuals to access financial services without the need for a traditional bank account. This has the potential to empower millions of people around the world, driving economic growth and reducing poverty.

However, despite the numerous opportunities, challenges remain in the integration of blockchain and cryptocurrencies into the banking industry. Regulatory frameworks, security concerns, scalability issues, and public perception are among the hurdles that need to be addressed.

In conclusion, the combination of blockchain technology and cryptocurrencies is revolutionizing the banking industry. Financial institutions need to adapt to this technological shift to stay competitive and embrace the opportunities it presents. As blockchain and cryptocurrencies continue to evolve, the future of digital banking holds immense potential for innovation and transformation.

Conclusion

In conclusion, the future of digital banking looks promising with emerging trends and predictions. The shift towards mobile banking, the rise of artificial intelligence, and the adoption of blockchain technology are reshaping the banking landscape. As customers seek convenience, personalized experiences, and enhanced security, banks need to stay ahead by embracing these advancements and continuously innovating. Overall, the future of digital banking holds great potential to transform the way we bank and interact with financial institutions.