The Evolution of Banking Technology: What’s Next? The banking industry has witnessed significant advancements in technology, revolutionizing the way we manage our finances. From online banking to mobile payments, this article explores the current trends and predicts what the future holds for banking technology.

Traditional Banking vs. Digital Banking

Banking technology has come a long way in recent years, transforming the way we manage our finances. One of the most significant developments in the banking industry is the rise of digital banking, which has challenged the traditional banking system. Let’s take a closer look at the differences between traditional banking and digital banking.

Traditional Banking

In traditional banking, customers have to physically visit a bank branch to carry out transactions, such as depositing or withdrawing money, applying for loans, or opening new accounts. This face-to-face interaction with bank staff may provide a sense of security and trust for some individuals. However, it can also be time-consuming, especially during peak hours or when the nearest bank branch is far away.

Traditional banks have a wide network of physical branches that customers can access. They offer personalized services, such as in-person consultations and advice, which can be beneficial for complex financial matters. Additionally, traditional banks have been in operation for a long time, building a reputation and trust among customers.

Digital Banking

Digital banking, on the other hand, allows customers to access their accounts and conduct banking transactions through online platforms or mobile applications. It offers convenience and flexibility as customers can perform banking activities anytime and anywhere without the need to visit a physical bank branch.

With digital banking, customers can easily check their account balances, transfer money, pay bills, and even apply for loans or credit cards. Transactions are secured through encryption technology, ensuring the safety of customers’ personal and financial information.

The Advantages of Digital Banking

There are several advantages to digital banking:

- Convenience: Digital banking provides 24/7 access to banking services, eliminating the need to wait in long queues.

- Time-saving: With digital banking, transactions can be completed quickly, saving valuable time.

- Lower fees: Digital banks often have lower operational costs, allowing them to offer services with lower fees or no fees at all.

- Enhanced security: Digital banking platforms invest heavily in security measures to protect customers’ accounts and sensitive data.

The Future of Banking Technology

The rapid advancement of technology continues to reshape the banking industry. As digital banking gains popularity, traditional banks are also digitizing their services to remain competitive. The future of banking technology may involve artificial intelligence (AI), machine learning, blockchain, and biometric authentication.

Overall, the evolution of banking technology has brought about a shift from traditional banking towards digital banking. While both options have their pros and cons, it’s clear that digital banking offers greater convenience and flexibility for customers. As technology continues to evolve, it will be interesting to see how banking services will further transform in the years to come.

Mobile Banking and its Convenience

With the rapid advancement of technology, banking has become more convenient than ever before. One significant development in the banking industry is the introduction of mobile banking services. Mobile banking allows customers to manage their financial transactions through their smartphones and other mobile devices.

One of the main advantages of mobile banking is the ease of access it provides. Users can check their account balances, transfer funds, pay bills, and even deposit checks from anywhere at any time. This level of flexibility and convenience is particularly beneficial for busy individuals who are always on the go.

Moreover, mobile banking offers a secure and efficient way to handle financial transactions. Banks have implemented multiple security measures, such as password protection and biometric authentication, to ensure the safety of users’ sensitive information. This not only provides peace of mind to customers but also prevents fraudulent activities.

Another advantage of mobile banking is the ability to receive real-time notifications. Whether it’s a transaction alert, account balance update, or payment reminder, users can stay informed about their financial activities. This feature helps users manage their money more effectively and avoid any potential issues.

Furthermore, mobile banking eliminates the need to visit physical bank branches. This saves customers valuable time and reduces the hassle of waiting in long queues. Additionally, it promotes environmental sustainability by reducing paper waste from traditional banking methods.

As technology continues to evolve, the future of mobile banking looks promising. With advancements in artificial intelligence, machine learning, and blockchain technology, we can expect enhanced security measures, personalized financial insights, and more innovative features to further improve the mobile banking experience.

The Rise of Fintech Companies

Fintech, which stands for financial technology, has emerged as a game-changer in the banking industry. With advancements in digital technology and the increasing demand for convenient banking solutions, fintech companies have gained significant traction in recent years.

One of the main reasons behind the rise of fintech companies is their ability to provide innovative financial services that traditional banks often struggle to offer. From mobile banking and digital wallets to peer-to-peer lending and robo-advisory platforms, fintech companies have introduced a wide range of solutions that cater to the needs of tech-savvy consumers.

Furthermore, fintech companies have capitalized on the power of data analytics and artificial intelligence to personalize financial experiences and improve risk assessment. By leveraging user data, these companies can offer tailored products and services, which ultimately enhance customer satisfaction.

Another significant factor contributing to the success of fintech companies is their agility and flexibility compared to traditional banks. Being less burdened by complex organizational structures and legacy systems, fintech startups can adapt quickly to market trends and customer demands. This enables them to bring new products and services to the market at a faster pace.

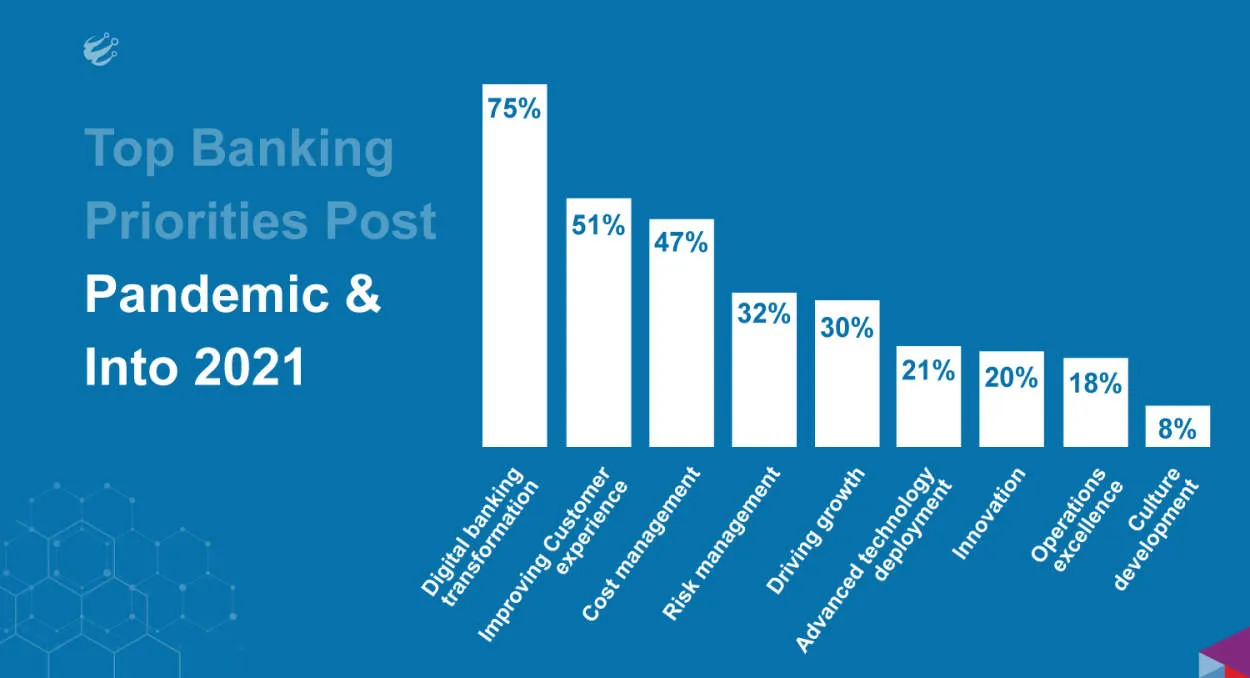

The rise of fintech companies has also fostered increased competition within the banking industry. As consumers become more aware of the convenience and benefits offered by fintech solutions, they are more willing to switch from traditional banks to these innovative alternatives. This has prompted traditional banks to invest in their own digital transformation initiatives to stay relevant and competitive.

In conclusion, the rise of fintech companies has revolutionized the banking industry. Their ability to provide innovative solutions, personalize financial services, and adapt quickly to market trends has disrupted the traditional banking landscape. As technology continues to advance, it will be intriguing to witness the next wave of evolution in banking technology and the impact it will have on our financial experiences.

Emerging Technologies in the Banking Industry

The banking industry has been constantly evolving over the years, and advanced technologies have played a crucial role in driving this transformation. These emerging technologies are reshaping the way banks operate and provide services to their customers. Let’s explore some of the key technologies that are driving this evolution.

1. Artificial Intelligence (AI)

AI is revolutionizing the banking sector by enabling personalized customer experiences, fraud detection and prevention, and predictive analytics. Banks are leveraging AI-powered chatbots to enhance customer support and offer virtual assistance. Additionally, machine learning algorithms are being adopted for credit risk assessment and fraud detection, helping banks make faster and more accurate decisions.

2. Blockchain

Blockchain technology is streamlining banking operations by providing secure and transparent transactions. It allows banks to transfer assets, such as money or ownership records, quickly and securely without the need for intermediaries. This decentralizes the banking system and reduces the risk of fraud, making transactions more efficient and cost-effective.

3. Biometric Authentication

Biometric authentication methods, such as fingerprint, facial, and voice recognition, are gaining popularity in the banking industry. These technologies provide stronger security and eliminate the need for cumbersome passwords or PINs. By implementing biometric authentication, banks can enhance customer security while simplifying the login and transaction processes.

4. Internet of Things (IoT)

The integration of IoT devices with banking systems allows for seamless and real-time communication between customers and banks. IoT-enabled devices, such as wearables or smart devices, can provide personalized financial advice, enable contactless payments, and enhance fraud detection. Moreover, IoT data can assist banks in analyzing consumer behaviors and preferences, leading to more targeted and efficient marketing campaigns.

5. Robotic Process Automation (RPA)

RPA is automating repetitive tasks in the banking industry, enhancing efficiency and reducing human errors. Banks are utilizing RPA to streamline customer onboarding processes, loan application assessments, and compliance checks. By automating these tasks, banks can allocate their resources to more complex and value-added activities.

These emerging technologies are transforming the banking industry, ushering in a new era of efficiency, security, and customer-centricity. As technology continues to advance, banks must embrace these innovations to stay competitive and meet the evolving demands of their customers.

Conclusion

In conclusion, the evolution of banking technology has revolutionized the way banks operate and serve their customers. From the introduction of ATMs to internet banking and mobile applications, the industry has witnessed significant advancements. Looking ahead, the future of banking technology holds promising innovations such as blockchain, artificial intelligence, and biometric authentication, which will further enhance security, convenience, and efficiency in the banking sector.