As Millennials navigate the rapidly changing financial landscape, they face unique challenges in building wealth. From unprecedented student loan debt to the gig economy, this article explores the strategies and adaptations necessary for Millennials to thrive and build financial security in today’s world.

Understanding the Unique Financial Landscape for Millennials

Millennials, born between 1981 and 1996, face a financial landscape unlike any previous generation. Rapid technological advancements, the burden of student loan debt, and economic instability have created both challenges and opportunities for millennials when it comes to building wealth.

One key aspect of the financial landscape for millennials is the impact of technology. With the rise of the internet and digital platforms, millennials have access to a wealth of information and resources at their fingertips. They can easily research investment options, track their spending, and even automate their savings. However, they also face the risk of information overload and the need to navigate a constantly evolving digital world.

Additionally, millennials have been heavily burdened by student loan debt. Many have been forced to delay major life milestones such as buying a house or starting a family due to the financial strain of their student loans. This debt also impacts their ability to invest and save for the future. As millennials work to pay off these loans, they must find creative ways to balance debt repayment with building wealth.

The economic instability experienced by millennials is another crucial factor to consider. Many entered the workforce during or after the Great Recession, facing limited job opportunities and stagnant wages. This has resulted in financial insecurity and a need to make strategic financial decisions to secure their financial future.

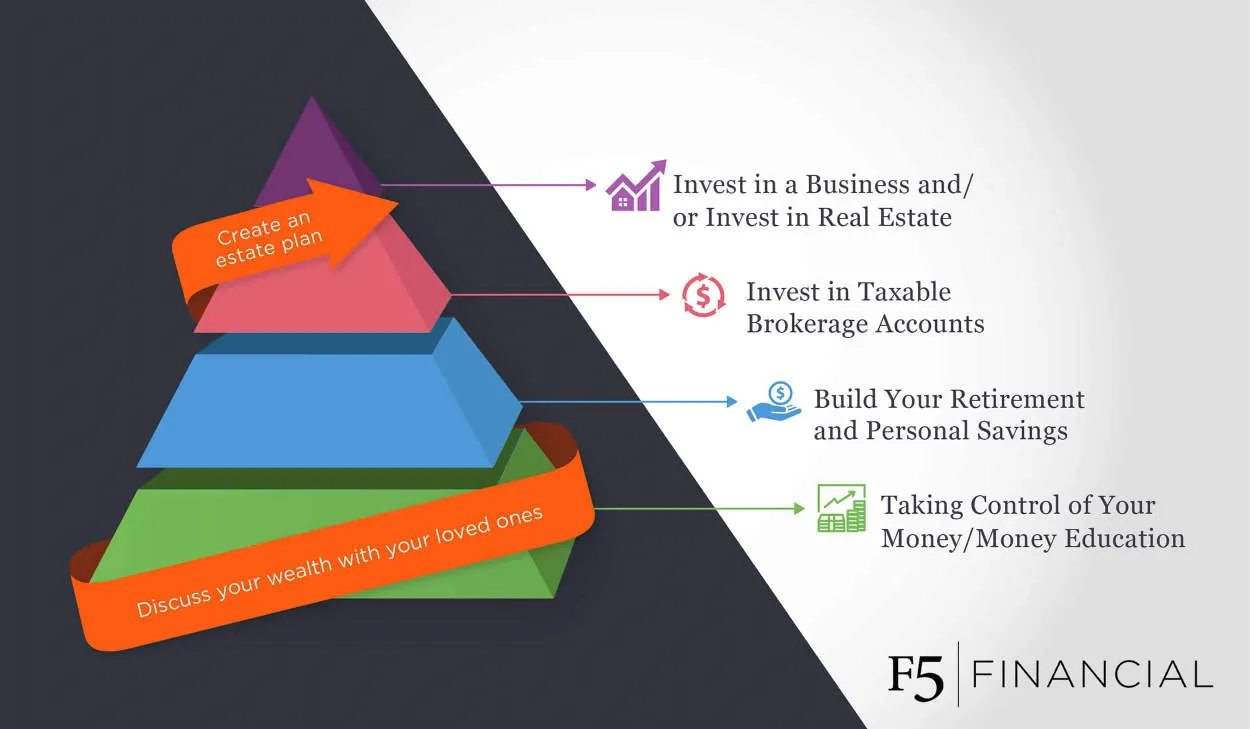

In order to adapt to these unique challenges, millennials must embrace new strategies for wealth building. This includes focusing on financial education and literacy, seeking out mentors and advisors who can provide guidance, and exploring alternative investment options such as peer-to-peer lending or real estate crowdfunding. Additionally, millennials should prioritize budgeting, saving, and investing early, even with limited resources.

Overall, understanding the unique financial landscape for millennials is crucial in order to effectively navigate the challenges and opportunities they face in building wealth. By adapting to new financial challenges and embracing innovative strategies, millennials can proactively shape their financial future.

Crafting a Personalized Wealth Building Plan

In today’s rapidly changing financial landscape, millennials are faced with unique challenges when it comes to building wealth. The traditional methods that previous generations relied on may no longer be applicable in today’s world. To adapt to these new challenges, it is crucial for millennials to craft a personalized wealth building plan that takes into account their unique circumstances and goals.

First and foremost, millennials should start by assessing their current financial situation. This includes understanding their income, expenses, and any outstanding debts. By having a clear picture of their financial standing, they can identify areas for improvement and set realistic goals.

Next, millennials should prioritize saving and investing. With the rising cost of living and uncertain economic conditions, saving money has never been more important. Setting aside a portion of each paycheck for savings can help build an emergency fund and provide a solid foundation for future investments.

When it comes to investing, millennials should educate themselves about different investment options and consider seeking professional advice. Investing in a diverse portfolio of stocks, bonds, and real estate can help millennials grow their wealth over time and mitigate risk.

In addition to saving and investing, millennials should also focus on increasing their earning potential. This can be achieved through continuous learning, acquiring new skills, and exploring entrepreneurial opportunities. By increasing their income, millennials can accelerate their wealth-building journey and have more financial freedom.

Lastly, millennials should regularly review and adjust their wealth building plan as their circumstances change. Life events such as getting married, starting a family, or changing careers may require modifications to the plan. It is important for millennials to remain flexible and adapt their strategies accordingly.

In conclusion, crafting a personalized wealth building plan is essential for millennials to overcome the new financial challenges they face. By assessing their current financial situation, prioritizing saving and investing, increasing their earning potential, and regularly reviewing their plan, millennials can build a solid foundation for long-term financial success.

Utilizing Technology for Financial Management

In today’s digital age, technology has become an invaluable tool for managing personal finances. This is especially true for millennials who face unique financial challenges. With rising student loan debts, increased living costs, and a highly competitive job market, millennials need to adapt and make the most of available technology to build wealth and secure their financial futures.

One way technology can aid millennials in financial management is through budgeting apps. These apps allow users to track expenses, set financial goals, and create personalized budgets. With real-time notifications and spending analysis, millennials can easily stay on top of their finances and make informed financial decisions.

Another useful technology for financial management is online investment platforms. These platforms provide millennials with easy access to investment opportunities, even with limited funds. Through robo-advisors and automated investing tools, millennials can start investing with low fees and minimal effort. This not only helps them grow their wealth but also learn about the various investment options available.

Furthermore, technology has revolutionized banking and payment systems. Millennials can now conveniently perform banking transactions, such as transferring money, paying bills, and depositing checks, all from their smartphones. With the rise of digital wallets, mobile banking apps, and peer-to-peer payment platforms, traditional banking hassles are minimized, making financial management more efficient.

Lastly, technology has opened up new avenues for learning and financial education. Online resources, such as blogs, podcasts, and online courses, provide millennials with access to valuable financial knowledge. They can learn about topics like budgeting, investing, and debt management at their own pace and convenience. This empowers millennials to take control of their finances and make well-informed financial decisions.

Overcoming Common Obstacles Faced by Millennial Investors

As millennials navigate the world of wealth building, they often encounter unique challenges that require adaptation and perseverance. While aiming to secure a stable financial future, they must overcome the following common obstacles:

1. Student Loan Debt

Millennials face the burden of hefty student loan debt, which can impede their ability to invest and accumulate wealth. Prioritizing debt repayment while seeking alternative solutions, such as refinancing or exploring forgiveness programs, is crucial to overcome this hurdle.

2. Fickle Job Market

The rapidly evolving job market poses challenges for millennials to establish stable careers. They may encounter frequent job changes or uncertainty, requiring adaptability and resilience. Building a diverse set of skills and pursuing continuous learning can enhance career prospects.

3. High Cost of Living

Millennials often face a high cost of living, especially in urban areas where housing and daily expenses can be substantial. Budgeting wisely, opting for shared living spaces, and carefully evaluating expenses can help overcome this obstacle and free up funds for investing.

4. Lack of Financial Literacy

A significant number of millennials lack the necessary financial knowledge to make informed investment decisions. Education in personal finance, seeking guidance from experts, and utilizing digital resources are essential steps to overcome this knowledge gap.

5. Volatile Market Conditions

The unpredictable nature of financial markets can intimidate millennial investors. Developing a long-term investment strategy, diversifying portfolios, and staying up-to-date with market trends are valuable approaches to mitigate risks and achieve long-term growth.

By recognizing and actively addressing these obstacles, millennial investors can empower themselves to adapt to new financial challenges and build lasting wealth.

Conclusion

As millennials face unique financial challenges, such as student debt and a changing job market, it is crucial for them to adapt their wealth-building strategies. By focusing on long-term goals, seeking financial education, embracing technological tools, and prioritizing saving and investing, millennials can overcome these challenges and build a strong financial foundation for the future.